- international trade

-

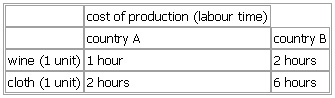

Introductioneconomic transactions that are made between countries. Among the items commonly traded are consumer goods, such as television sets and clothing; capital goods, such as machinery; and raw materials and food. Other transactions involve services, such as travel services and payments for foreign patents (see service industry). International trade transactions are facilitated by international financial payments, in which the private banking system and the central banks of the trading nations play important roles.International trade and the accompanying financial transactions are generally conducted for the purpose of providing a nation with commodities it lacks in exchange for those that it produces in abundance; such transactions, functioning with other economic policies, tend to improve a nation's standard of living. Much of the modern history of international relations concerns efforts to promote freer trade among nations. This article provides a historical overview of the structure of international trade and of the leading institutions that were developed to promote such trade.Historical overviewThe barter of goods or services among different peoples is an age-old practice, probably as old as human history. International trade, however, refers specifically to an exchange between members of different nations, and accounts and explanations of such trade begin (despite fragmentary earlier discussion) only with the rise of the modern nation-state at the close of the European Middle Ages. As political thinkers and philosophers began to examine the nature and function of the nation, trade with other countries became a particular topic of their inquiry. It is, accordingly, no surprise to find one of the earliest attempts to describe the function of international trade within that highly nationalistic body of thought now known as mercantilism.Mercantilist analysis, which reached the peak of its influence upon European thought in the 16th and 17th centuries, focused directly upon the welfare of the nation. It insisted that the acquisition of wealth, particularly wealth in the form of gold, was of paramount importance for national policy. Mercantilists took the virtues of gold almost as an article of faith; consequently, they never sought to explain adequately why the pursuit of gold deserved such a high priority in their economic plans.Mercantilism was based on the conviction that national interests are inevitably in conflict—that one nation can increase its trade only at the expense of other nations. Thus, governments were led to impose price and wage controls, foster national industries, promote exports of finished goods and imports of raw materials, while at the same time limiting the exports of raw materials and the imports of finished goods. The state endeavoured to provide its citizens with a monopoly of the resources and trade outlets of its colonies.The trade policy dictated by mercantilist philosophy was accordingly simple: encourage exports, discourage imports, and take the proceeds of the resulting export surplus in gold. Mercantilists' ideas often were intellectually shallow, and indeed their trade policy may have been little more than a rationalization of the interests of a rising merchant class that wanted wider markets—hence the emphasis on expanding exports—coupled with protection against competition in the form of imported goods.A typical illustration of the mercantilist spirit is the English Navigation Act (Navigation Acts) of 1651 (see Navigation Acts), which reserved for the home country the right to trade with its colonies and prohibited the import of goods of non-European origin unless transported in ships flying the English flag. This law lingered until 1849. A similar policy was followed in France.A strong reaction against mercantilist attitudes began to take shape toward the middle of the 18th century. In France, the economists known as Physiocrats (physiocrat) demanded liberty of production and trade (free trade). In England, economist Adam Smith (Smith, Adam) demonstrated in his book The Wealth of Nations (1776) the advantages of removing trade restrictions. Economists and businessmen voiced their opposition to excessively high and often prohibitive customs duties and urged the negotiation of trade agreements (trade agreement) with foreign powers. This change in attitudes led to the signing of a number of agreements embodying the new liberal ideas about trade, among them the Anglo-French Treaty of 1786, which ended what had been an economic war between the two countries.After Adam Smith, the basic tenets of mercantilism were no longer considered defensible. This did not, however, mean that nations abandoned all mercantilist policies. Restrictive economic policies were now justified by the claim that, up to a certain point, the government should keep foreign merchandise off the domestic market in order to shelter national production from outside competition. To this end, customs levies were introduced in increasing number, replacing outright bans on imports, which became less and less frequent.In the middle of the 19th century, a protective customs policy effectively sheltered many national economies from outside competition. The French tariff of 1860, for example, charged extremely high rates on British products: 60 percent on pig iron; 40 to 50 percent on machinery; and 600 to 800 percent on woolen blankets. Transport costs between the two countries provided further protection.A triumph for liberal ideas was the Anglo-French trade agreement of 1860, which provided that French protective duties were to be reduced to a maximum of 25 percent within five years, with free entry of all French products except wines into Britain. This agreement was followed by other European trade pacts.Resurgence of protectionismA reaction in favour of protection spread throughout the Western world in the latter part of the 19th century. Germany adopted a systematically protectionist policy and was soon followed by most other nations. Shortly after 1860, during the Civil War, the United States raised its duties sharply; the McKinley Tariff Act of 1890 was ultraprotectionist. The United Kingdom was the only country to remain faithful to the principles of free trade.But the protectionism of the last quarter of the 19th century was mild by comparison with the mercantilist policies that had been common in the 17th century and were to be revived between the two world wars. Extensive economic liberty prevailed by 1913. Quantitative restrictions were unheard of, and customs duties were low and stable. Currencies were freely convertible into gold, which in effect was a common international money. Balance-of-payments problems were few. People who wished to settle and work in a country could go where they wished with few restrictions; they could open businesses, enter trade, or export capital freely. Equal opportunity to compete was the general rule, the sole exception being the existence of limited customs preferences between certain countries, most usually between a home country and its colonies. Trade was freer throughout the Western world in 1913 than it was in Europe in 1970.The “new” mercantilismWorld War I wrought havoc on these orderly trading conditions. By the end of the hostilities, world trade had been disrupted to a degree that made recovery very difficult. The first five years of the postwar period were marked by the dismantling of wartime controls. An economic downturn in 1920, followed by the commercial advantages that accrued to countries whose currencies had depreciated (as had Germany's), prompted many countries to impose new trade restrictions. The resulting protectionist tide engulfed the world economy, not because policy makers consciously adhered to any specific theory but because of nationalist ideologies and the pressure of economic conditions. In an attempt to end the continual raising of customs barriers, the League of Nations (Nations, League of) organized the first World Economic Conference in May 1927. Twenty-nine states, including the main industrial countries, subscribed to an international convention that was the most minutely detailed and balanced multilateral trade agreement approved to date. It was a precursor of the arrangements made under the General Agreement on Tariffs and Trade (GATT) of 1947.However, the 1927 agreement remained practically without effect. During the Great Depression of the 1930s, unemployment in major countries reached unprecedented levels and engendered an epidemic of protectionist measures. Countries attempted to shore up their balance of payments by raising their customs duties and introducing a range of import quotas or even import prohibitions, accompanied by exchange controls (exchange control).From 1933 onward, the recommendations of all the postwar economic conferences based on the fundamental postulates of economic liberalism were ignored. The planning of foreign trade came to be considered a normal function of the state. Mercantilist policies dominated the world scene until after World War II, when trade agreements and supranational organizations became the chief means of managing and promoting international trade.The theory of international tradeComparative-advantage analysisThe British school of classical economics began in no small measure as a reaction against the inconsistencies of mercantilist thought. Adam Smith (Smith, Adam) was the 18th-century founder of this school; as mentioned above, his famous work, The Wealth of Nations (1776), is in part an antimercantilist tract. In the book, Smith emphasized the importance of specialization as a source of increased output, and he treated international trade as a particular instance of specialization: in a world where productive resources are scarce and human wants cannot be completely satisfied, each nation should specialize in the production of goods it is particularly well equipped to produce; it should export part of this production, taking in exchange other goods that it cannot so readily turn out. Smith did not expand these ideas at much length, but another classical economist, David Ricardo (Ricardo, David), developed them into the principle of comparative advantage, a principle still to be found, much as Ricardo spelled it out, in contemporary textbooks on international trade.Simplified theory of comparative advantageFor clarity of exposition, the theory of comparative advantage is usually first outlined as though only two countries and only two commodities (commodity trade) were involved, although the principles are by no means limited to such cases. Again for clarity, the cost of production is usually measured only in terms of labour time and effort; the cost of a unit of cloth, for example, might be given as two hours of work. The two countries will be called A and B; and the two commodities produced, wine and cloth. The labour time required to produce a unit of either commodity in either country is as follows:cost of production (labour time)country A country Bwine (1 unit) 1 hour 2 hourscloth (1 unit) 2 hours 6 hoursSee as table:

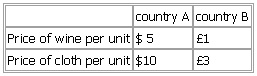

As compared with country A, country B is productively inefficient. Its workers need more time to turn out a unit of wine or a unit of cloth. This relative inefficiency may result from differences in climate, in worker training or skill, in the amount of available tools and equipment, or from numerous other reasons. Ricardo took it for granted that such differences do exist, and he was not concerned with their origins.Country A is said to have an absolute advantage in the production of both wine and cloth because it is more efficient in the production of both goods. Accordingly, A's absolute advantage seemingly invites the conclusion that country B could not possibly compete with country A, and indeed that if trade were to be opened up between them, country B would be competitively overwhelmed. Ricardo, who focused chiefly on labour costs, insisted that this conclusion is false. The critical factor is that country B's disadvantage is less pronounced in wine production, in which its workers require only twice as much time for a single unit as do the workers in A, than it is in cloth production, in which the required time is three times as great. This means, Ricardo pointed out, that country B will have a comparative advantage in wine production. Both countries will profit, in terms of the real income they enjoy, if country B specializes in wine production, exporting part of its output to country A, and if country A specializes in cloth production, exporting part of its output to country B. Paradoxical though it may seem, it is preferable for country A to leave wine production to country B, despite the fact that A's workers can produce wine of equal quality in half the time that B's workers can do so.The incentive to export and to import can be explained in price (price system) terms. In country A (before international trade), the price of cloth ought to be twice that of wine, since a unit of cloth requires twice as much labour effort. If this price ratio is not satisfied, one of the two commodities will be overpriced and the other underpriced. Labour will then move out of the underpriced occupation and into the other, until the resulting shortage of the underpriced commodity drives up its price. In country B (again, before trade), a cloth unit should cost three times as much as a wine unit, since a unit of cloth requires three times as much labour effort. Hence, a typical before-trade price relationship, matching the underlying real cost ratio in each country, might be as follows:country A country BPrice of wine per unit $ 5 £1Price of cloth per unit $10 £3See as table: